Seamless

APM

Processing

Expand your payment options with flexible

alternative payment methods optimized for

the global market.

What is APM?

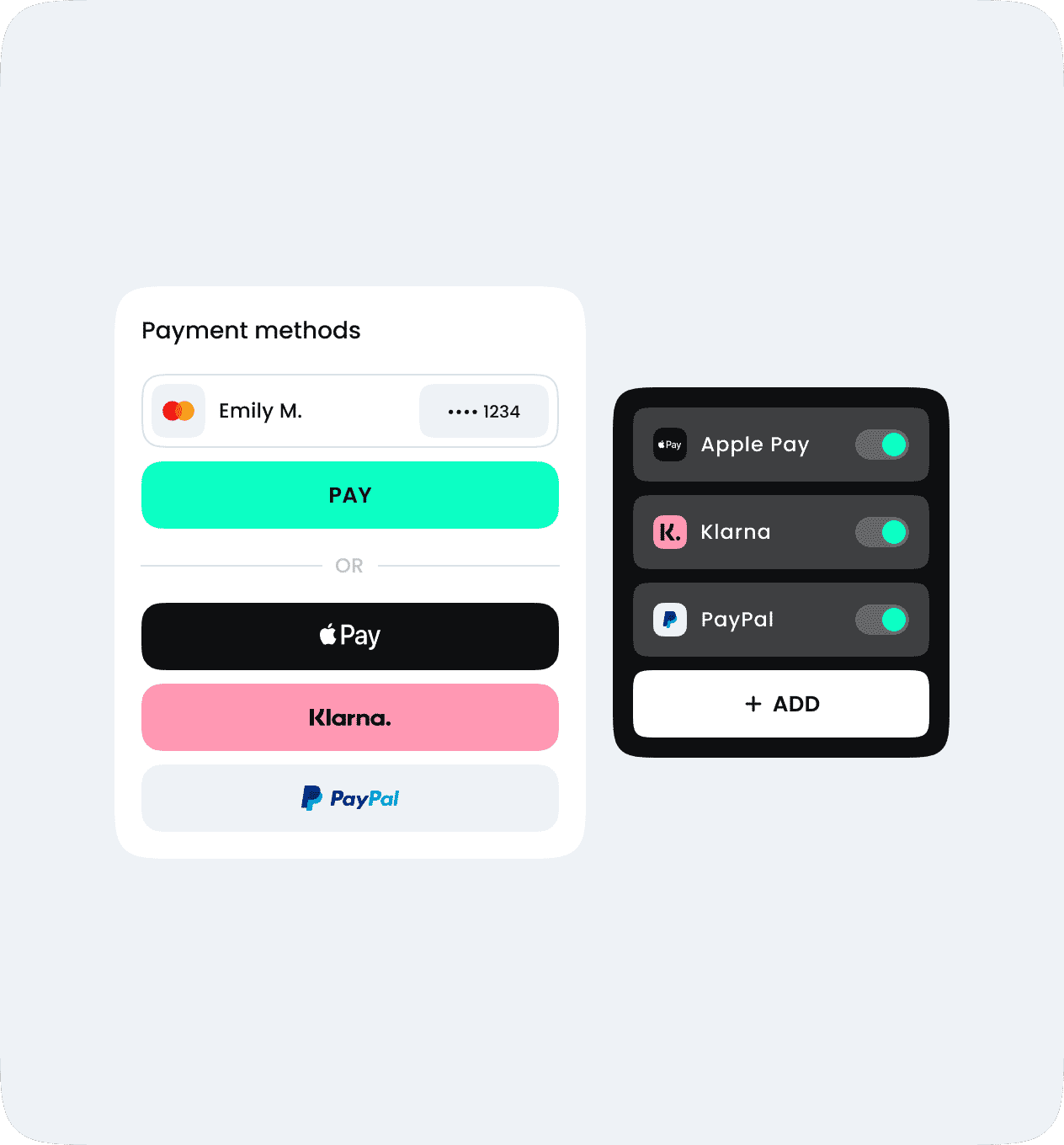

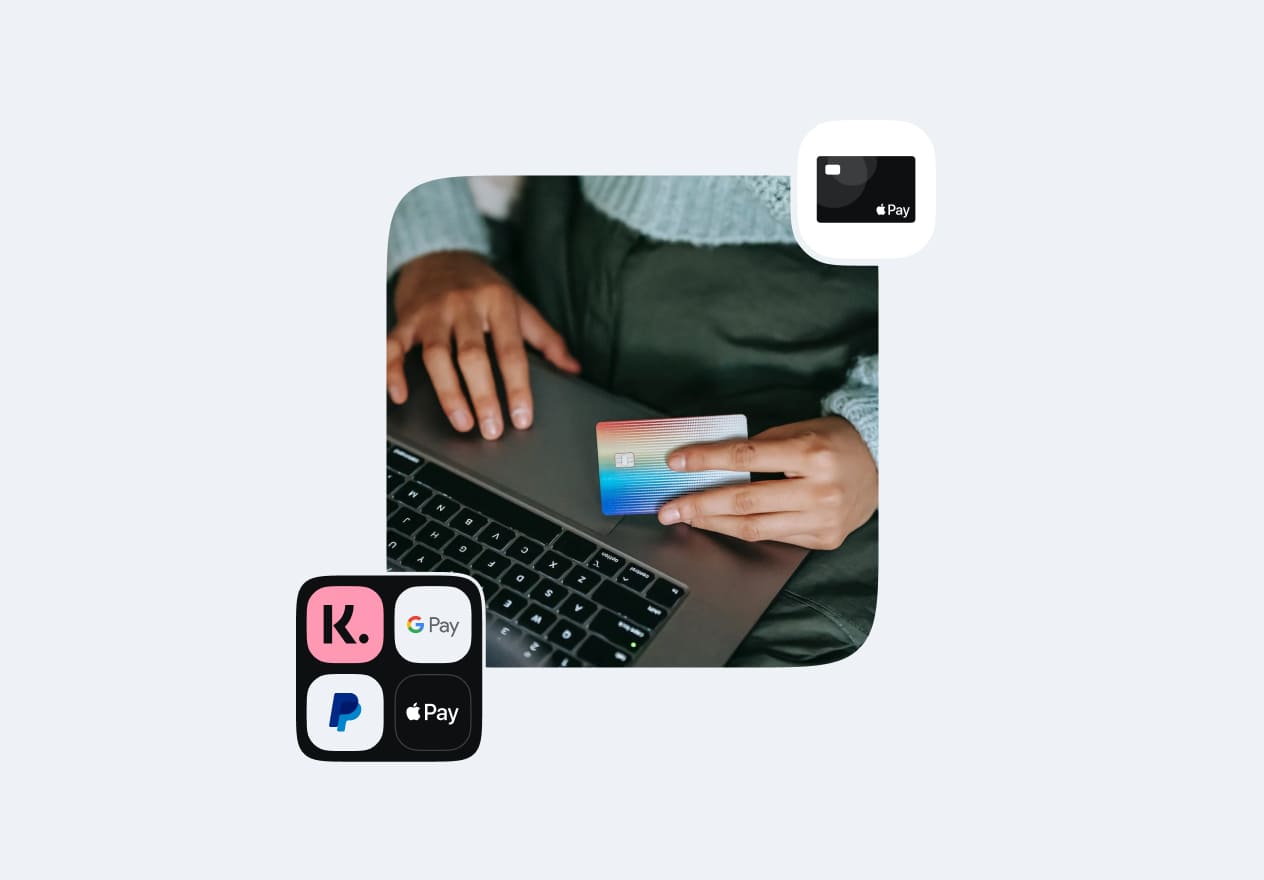

APMs include a variety of payment methods beyond traditional credit cards, such as bank transfers, e-wallets, mobile payments, and more.

These methods give your customers flexibility of choice, improving the user experience and increasing conversions.

Importance of APM for your business

Engage more customers by prioritizing localized payment solutions that meet their specific needs and cultural sensitivities.

APMs can significantly reduce payment declines and increase trust in your brand.

Open your business to a world

of possibilities with our alternative

payment methods

From mobile payments to bank transfers and e-wallets, our platform offers a complete solution to meet global payment needs.

Optimize your payments

for each continent

Our APMs are geographically tailored to help

you enter new markets with ease.

Apple Pay

Apple Pay

Google Pay

Google Pay

Klarna

Klarna

PayPal

PayPal

American Express

American Express

SEPA

SEPA

Bancontact

Bancontact

Giropay

Giropay

iDeal

iDeal

Przelewy24

Przelewy24

Paysafecard

Paysafecard

Alipay

Alipay

UnionPay

UnionPay

Airtel Money

Airtel Money

WeChat Pay

WeChat Pay

Sofort

Sofort

EPS

EPS

Mybank

Mybank

Paystack

Paystack

MercadoPago

MercadoPago

Boleto Bancário

Boleto Bancário

Affirm

Affirm

Amazon Pay

Amazon Pay

Pix

Pix

Oxxo

Oxxo

Western Union

Western Union

Fawry

Fawry

Orange

Orange

Vodacom

Vodacom

mCash

mCash

Apple Pay

Apple Pay

Google Pay

Google Pay

Klarna

Klarna

PayPal

PayPal

SEPA

SEPA

Giropay

Giropay

iDeal

iDeal

Paysafecard

Paysafecard

Bancontact

Bancontact

Przelewy24

Przelewy24

Sofort

Sofort

EPS

EPS

Apple Pay

Apple Pay

Google Pay

Google Pay

Alipay

Alipay

UnionPay

UnionPay

WeChat Pay

WeChat Pay

Apple Pay

Apple Pay

Google Pay

Google Pay

Amazon Pay

Amazon Pay

Klarna

Klarna

PayPal

PayPal

American Express

American Express

Sofort

Sofort

EPS

EPS

Mybank

Mybank

Affirm

Affirm

Apple Pay

Apple Pay

Google Pay

Google Pay

PayPal

PayPal

MercadoPago

MercadoPago

Pix

Pix

Boleto Bancário

Boleto Bancário

Oxxo

Oxxo

Western Union

Western Union

Airtel Money

Airtel Money

Paystack

Paystack

Fawry

Fawry

Vodacom

Vodacom

Orange

Orange

mCash

mCash

PayTX is committed to being your partner in growth, ensuring that you always have at least one APM option available in every market or country.

For APMs interested in joining our network and expanding their reach, we invite you to contact us at apm@paytx.com to explore integration opportunities.

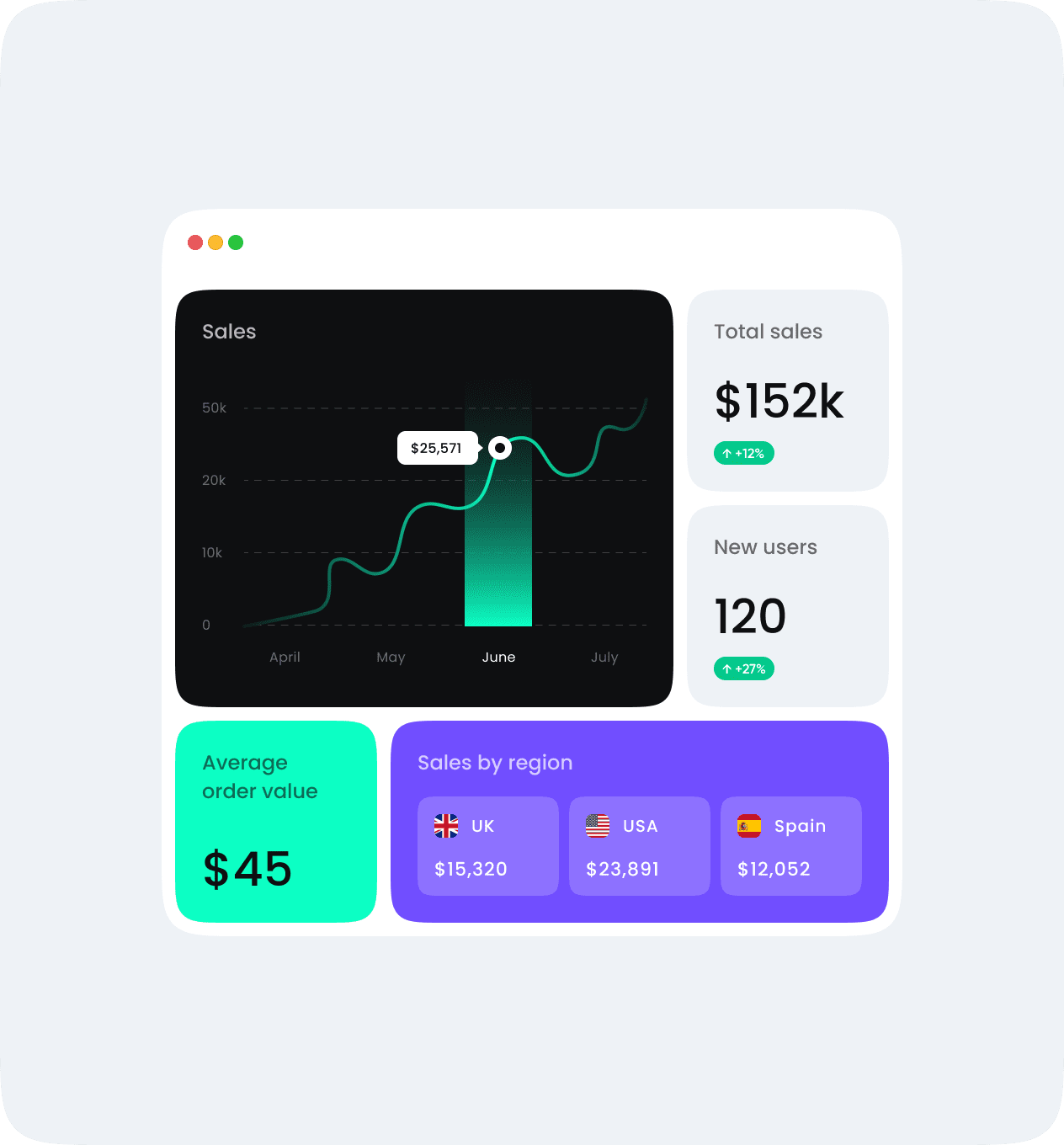

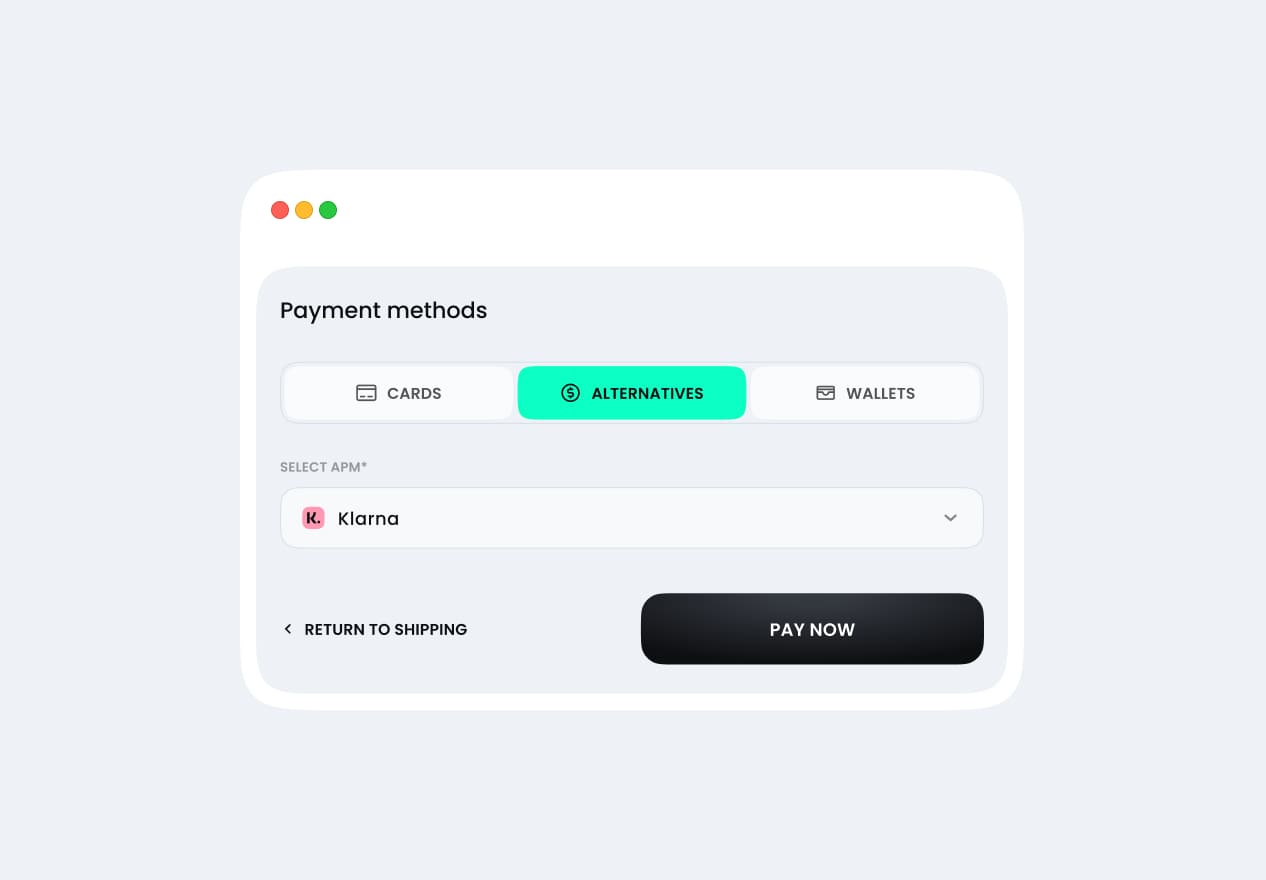

One platform to manage

online payments

A single integration working with multiple payment providers

Fully certified for standards such as PSD2 and PCI-DSS

Full visibility of your entire payment stack and its performance

Customizable & dynamic checkout for web and mobile

A single integration working with multiple payment providers

Fully certified for standards such as PSD2 and PCI-DSS

Full visibility of your entire payment stack and its performance

What are the advantages of APM over traditional payment methods?

Are alternative payment methods safe?

How can I integrate APM into my business?

Are APMs available for international transactions?

How to choose the best APM for my business?

Still have other questions?

Go to support

Get an exceptional

payment

processing

experience

Leverage PayTX trusted by

customer-first brands

for reliable

payment processing at scale.